With high levels of inflation like those that we have seen over the last several months, individuals often experience negative impacts to their cash flow and have questions about how it might impact their net worth.

Tactical financial planning is centered around implementing a plan that will allow you to achieve your unique financial goals while remaining nimble when opportunities arise. With economic forces like volatility and inflation affecting your future plans, it sheds light on the importance of selecting asset allocations based on your personal situation, risks, and objectives.

Here are a few things we’re watching closely that have been driving inflation:

- Commodity prices: Commodity prices generally increase with heightened demand and/or decreased supply. Recently demand has risen for many reasons, including recovery from the pandemic. Likewise, supply has been hampered due to geopolitical forces and more. The soaring value of commodities in turn leads to the increased cost of goods and greater inflationary pressures. Commodities such as Wheat and Oil are currently down about 24% and 22%, respectively from the highs reached earlier this year but remain volatile.

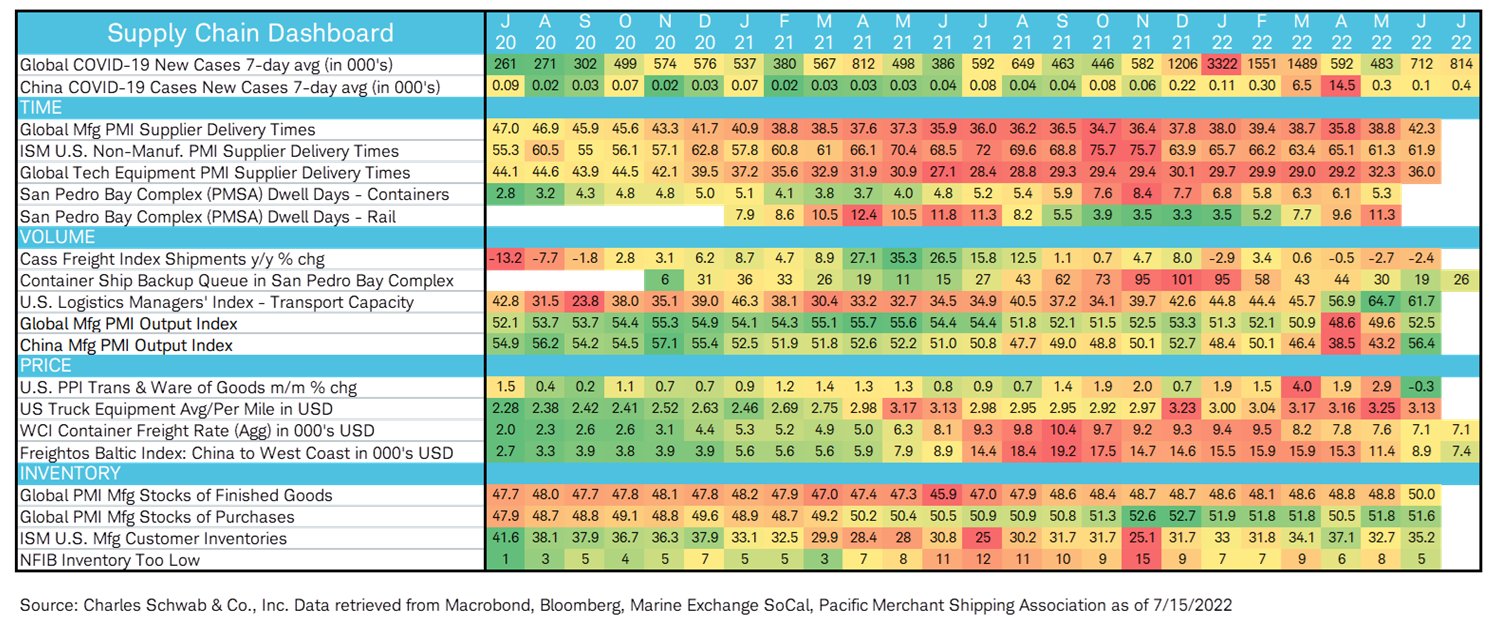

- Supply chain issues: Shortages in goods and labor cause supply chain bottlenecks. With decreased supply, consumers must pay more, again increasing prices and driving inflation. Recent trends show the supply chain constraints easing – the question is if this is sustainable?

- Uncertainty and labor shortage: Pandemic-related uncertainty has contributed to decreased production. Further, a global shortage of drivers and laborers has created a shortage in products and made it difficult to expand capacity (which could lower prices). Companies incur additional costs with idle inventory, which get passed along to customers.

Let’s dig in to how you can proactively plan:

1. Understanding your plans for spending in retirement

At this point in a market cycle, it’s wise to look at projections for growth, withdrawal rates and cash flows over an extended period of time and determine how higher inflation can impact your plan’s probability of success. It is a prudent use of time and energy to fully consider what it means to maintain your lifestyle in retirement and achieve financial independence in light of current inflationary pressures. Prior to retirement, it can be challenging to delineate, for instance, which expenses are associated with your lifestyle vs. which are associated with raising children, etc. These types of complexities can make it difficult to come to a perfect understanding of what your spending habits may look like in retirement, which is why it makes sense to continue to evaluate this on an ongoing basis. Putting in the time to decipher your future spending habits will help you create a plan that ultimately allows you to become financially independent.

2. Maintaining a disciplined approach to asset allocation

Ensure that you are allocating resources in a manner that is sustainable from the perspective of your unique level of risk tolerance. Market and economic forces are always at play and will positively and negatively impact the performance of your financial strategy at any given time. It’s important to choose a plan that you can commit to without making emotional or reactionary changes, because shifting your strategy at inopportune times is ultimately one of the primary ways to derail your goals.

3. Adjusting your savings rate

The easiest money to save is money that you haven’t yet earned. Leverage bonuses, future raises, and unexpected or new influxes of cash to bolster your savings. Capturing a large portion of these dollars is one of the best and easiest ways to increase your savings rate and thus your confidence in reaching your goals.

4. Allocating excess cash during market pullbacks

Although it may seem somewhat counterintuitive, market pullbacks can be a tactical time to add excess cash to your investment strategy. We see the market pull back about a third every 5-6 years, and dip 10-14% within any given year. When those events occur, it can be a prime time to put money into the market. Because historically the market has always recovered, adding resources during these meaningful times can be an impactful way to grow your wealth and offset negative impacts of inflation.

5. Thoughtfully utilizing financing

As interest rates go up, financing purchases becomes more expensive. The importance of making large purchases vs. increasing your savings or investing rate should be an ongoing consideration, grounded in what’s happening in the economy at any given time. For example, if considering a large expense like a home renovation project, it’s wise to evaluate whether to use debt, assets, or consider waiting to take action.

6. Reevaluating protection

Inflation can cause assets that you own to appreciate in value while at the same time increasing the interest expense of liabilities – for instance, if your home has gone up in value, it makes sense to evaluate how much coverage you have in your homeowners policy. Assets and liabilities should be reevaluated, especially during times of high inflation, to ensure that you are properly protected in the event that something unexpected happens.

Inflation is always in play, and is something that we plan for in our financial strategies based on our clients’ unique long-term goals – that’s why it’s important to keep your expectations in line with these goals. While it may not be possible to completely avoid the short-term effects of inflation, there are actions that you can control to offset and withstand varying economic forces. To discuss your financial goals and strategy, please contact us.