Given the foreboding headlines spurring a bit of concern among investors recently, it's understandable to have some questions regarding the volatility of the market.

Though it may not seem like it, “bear markets” (those with 20%+ drops in index prices) are actually quite normal.

This insightful article shares some things you should know about bear markets. Our key takeaways at Certus Wealth Management – and additions – are as follows:

- As previously mentioned, bear markets are normal. It’s important to note that since 1945, there have been 14 bear markets in the S&P 500 Index or on average approximately once every 5.5 years. However, during bull markets, stocks have more than made up for short-term depreciation with an average increase of 114%.

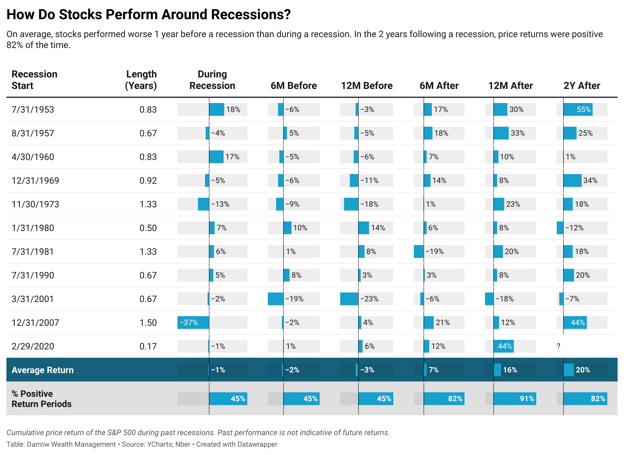

- Even in a recession, the market tends to be positive 91% of the time in the 12 months following the economic downturn.

- You will likely experience 5-6 bear markets over the course of a 30-year investment period, or for younger investors, 9-10 bear markets over a 50-year investment period. Watching your portfolio dip with the market can be difficult, but overall, markets are positive the majority of the time. Bear markets have comprised only 20.6 of the last 92 years of market history – meaning that stocks have been on the rise 78% of the time.

- Bear markets have historically been some of the most advantageous and impactful times to add resources to your portfolio.

At Certus Wealth Management, we are here to help you build and maintain an investment strategy designed specifically for your personal situation. If you have any questions, please don’t hesitate to reach out.