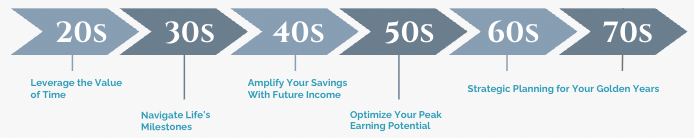

Age-specific considerations to guide your approach to retirement savings, investments & life milestones

20s: Leverage the Value of Time

Begin Saving 10% From Your First Job

Compounding interest is powerful. For example, at 22, saving $250 per month with an 8% growth rate can secure over $1,300,000 for your retirement by age 67. Waiting a decade means setting aside $575 per month (130% more) for the same result.

30s: Navigate Life's Milestones

Strategically Manage Life Changes with Continued Savings

With significant milestones like homeownership, marriage, or starting a family, your financial situation may get more intricate. Plan for these life expenditures while continuing to prioritize a 10% savings rate for retirement.

Consider establishing legal estate documents to protect your heirs and estate.

40s: Amplify Your Savings With Future Income

Allocate Future Income Increases for Enhanced Savings

Channel unearned income, such as a 3% raise, into bolstering your investment contributions while maintaining your current lifestyle. This savvy strategy can help ensure incremental savings growth without sacrificing your quality of life.

50s: Optimize Your Peak Earning Potential

Harness Your 401(k) and Explore Retirement Growth Strategies

Strive to maximize 401(k) contributions during your peak earning years to capitalize on catch-up contributions. Consider after-tax contributions, if your plan allows, for potential conversion into the Roth portion of your retirement account. Assess options for longterm care coverage, such as transferring this risk to an insurance company or choosing to self-insure.

60s & 70s: Strategic Planning for Your Golden Years

Maximize Your Social Security Benefits

Tailor your Social Security strategy to determine the most advantageous time to claim benefits. Research Medicare options and enrollment periods for comprehensive retirement healthcare coverage.

Craft Your Legacy and Estate Plan

Refine your legacy plan, encompassing estate decisions and preferences for distributing assets to heirs or charitable causes.

Navigate Required Minimum Distributions (RMDs)

Refine your legacy plan, encompassing estate decisions and preferences for distributing assets to heirs or charitable causes.

To schedule an appointment to discuss your needs, please contact us today.

This content is provided for educational purposes only, represents only a summary of topics discussed, does not constitute any personalized investment advice or recommendation, and represents only the views and opinions of the speakers which are subject to change without notice. Investing involves risk including the potential loss of all amounts invested.

This material prepared by Certus Wealth Management, LLC (“Certus Wealth”) is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Opinions expressed by Certus Wealth are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Certus Wealth, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Certus Wealth does not provide tax or legal advice, and nothing contained in these materials should be taken as tax or legal advice.